Navigating Emerging Risks and Regulatory Changes with a Robust AML Compliance Program

16.06.2025

16.06.2025

10 min read

10 min read

Current Regulatory Landscape

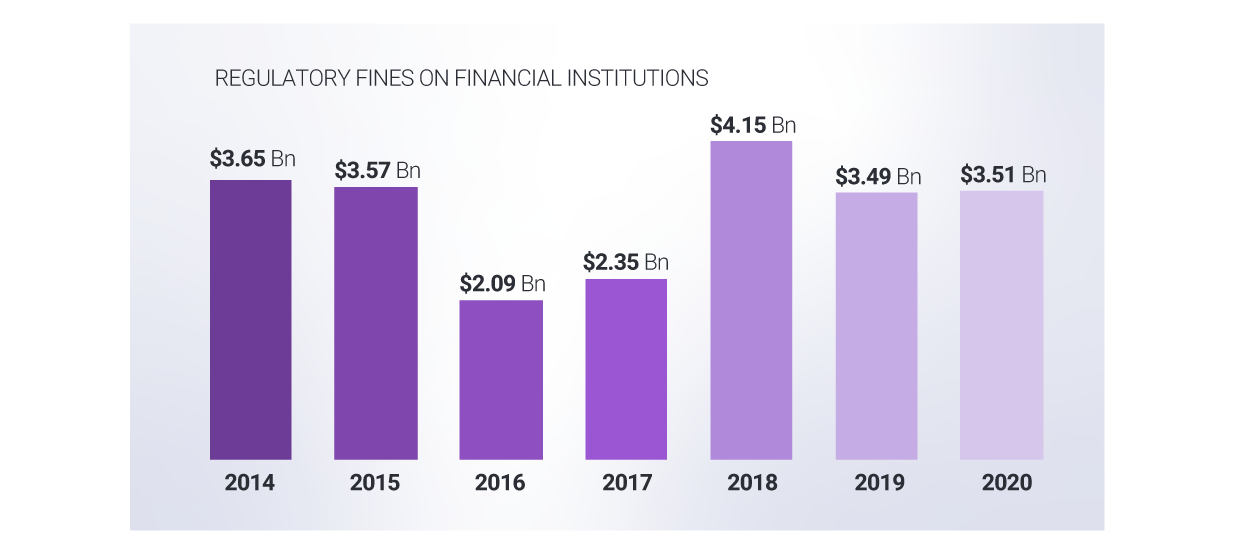

Regulators have fined financial institutions close to 20 billion dollars for Anti-Money Laundering (AML) shortcomings and regulatory violations in the last 6 years.

On December 11, 2020, the Senate passed the Anti-Money Laundering (AML) Act of 2020, which aimed to modernize AML/CFT guidelines by embracing technology and innovation, streamlining low-value processes, and eliminating obsolete regulations and guidance. This legislation accomplished its objective by implementing requirements that federal regulators appoint an Innovation Officer, establish a Bank Secrecy Act Advisory Group subcommittee on innovation and technology, FinCEN maintain emerging technology experts, and undergo a mandatory financial technology assessment by the Department of the Treasury.

Financial institutions have a crucial role in thwarting money laundering and terrorist financing infiltrating the financial system. They also face rising pressure to meet their compliance requirements, with increasing volumes of transactions, outdated technology, and human error. Additionally, the COVID-19 pandemic has mounted even more pressure on compliance teams to become more vigilant, as banks seek to quickly mitigate the financial impact of the pandemic and cybersecurity for remote employees.

Establishing a robust and sound Compliance program is one of the powerful deterrents against financial crimes; and, when implemented correctly, this program can minimize risk and prevent regulatory fines. Even though almost all financial institutions have implemented a program that mitigates exposure to money laundering and terrorist financing, often times these institutions fall behind with implementing the rapidly changing guidance and requirements by regulatory bodies. Compliance programs are becoming more complex in order to successfully meet these changes, incorporating advanced monitoring solutions, artificial intelligence, and empirical support all the while balancing overhead and resources.

The increase usage of machine learning, emerging technological innovations, and sharper regulatory scrutiny are driving change in combatting money laundering and terrorist financing. Where the traditional approach requires extensive manual interaction from humans to monitor and sift through false positives or true hits, the introduction of machine learning in the AML space has revolutionized the way financial ecosystems work. Machine learning can be configured to detect various typologies, trends, and behaviors, in order to track previously hidden patterns of customer behaviors and transactional activities. When compared to the traditional approach, machine learning generates lower false positives, reduces overhead, and decreases low-value manual work.

Both technology companies and financial institutions are actively designing innovative solutions like machine learning to better assess the riskiness of transacting with high-risk geographical jurisdictions, identify potentially suspicious movement of funds, and detect anomalous patterns in the transactions. Financial institutions are also investing in advanced analytics capabilities using intelligent algorithms that allows to convert raw data into valuable insights. Additionally, many are adopting new technological solutions for deep-dive analyses and dynamic reports, and creating new data integration and visualization tools that provide more thorough testing, in order to better identify trends and aberrations of complex criminal patterns.

Individuals involved in financial crimes and terrorist financing often change their tactics quicker than the regulators can keep up. The increased usage of online banking, electric payments, and virtual currencies assist in remitting and legitimizing illegal funds, which pose a threat to financial institutions in aiding these transactions and risk regulatory fines. There is a constant need for financial institutions to continuously improve and maintain their monitoring systems to detect and address suspicious activities in real-time.

Virtual currencies are fairly new, but have integrated into the financial system at lightning speed since their inception in 2009. However, financial institutions fall behind regulating them, and criminals benefit from these shortcomings. The Office of the Comptroller of the Currency (OCC) recently provided a “green signal” for financial institutions to provide fiat bank accounts and virtual currency custodial services to virtual currency businesses. Institutions serving virtual currency exchanges can now engage in using new technologies, like independent node verification networks (INVNs) and stable coins, to perform bank-permissible functions, such as payment activities, to address risks and risky behavior associated with virtual currency transactions: advanced technology, geographical risk, transaction size and frequency, transaction patterns, and source of funds. On January 14, 2021, FinCEN extended the comment period for a proposed rule aimed at closing anti-money laundering regulatory gaps for certain convertible virtual currency and digital asset transactions. In order to keep up with ever-changing technological and regulatory advances, we implement innovative financial solutions over more traditional ones, but this also adds to financial crimes and/or terrorist financing risks.

Apart from virtual currencies, marijuana-related businesses (MRBs) is another market that also is exposed to money laundering. Most MRBs struggle to find a bank willing to provide basic depositary and other financial services to them. This is due to the curious legal status of marijuana as a federally prohibited controlled substance, but a legal and highly sought-after commodity under the laws of most U.S. states. Currently, thirty-five states, the District of Columbia, Guam, and Puerto Rico have all legalized the use of marijuana to some degree. As most MRBs cannot obtain traditional banking services, these businesses must deal with an extensive amount of cash. Thus, the associated compliance costs and risks associated with MRB banking still can be substantial. This poses a fascinating mix of opportunity and risk from an AML perspective: although MRBs are no longer illegal under federal law, entities must obtain licenses under a federally sanctioned state law regime.

With the rise of online gambling, the Casino industry is seeing an upward trend in online betting. More and more states are legalizing online gambling, including Delaware, Michigan, New Jersey, Pennsylvania, and West Virginia. Social distancing protocols instituted as part of the COVID-19 response have further resulted in building closures and increased the popularity of these online platforms. While online gaming may be a new digital industry, their compliance responsibilities are still the same as that of a traditional casino. Casinos have been defined as “financial institutions” under the BSA since 1985. Casino (online or offline) also must file Suspicious Activity Reports (SARs) when it knows, suspects, or has reason to suspect that a transaction or attempted transaction is linked to illicit activity, or when it is simply inexplicable.

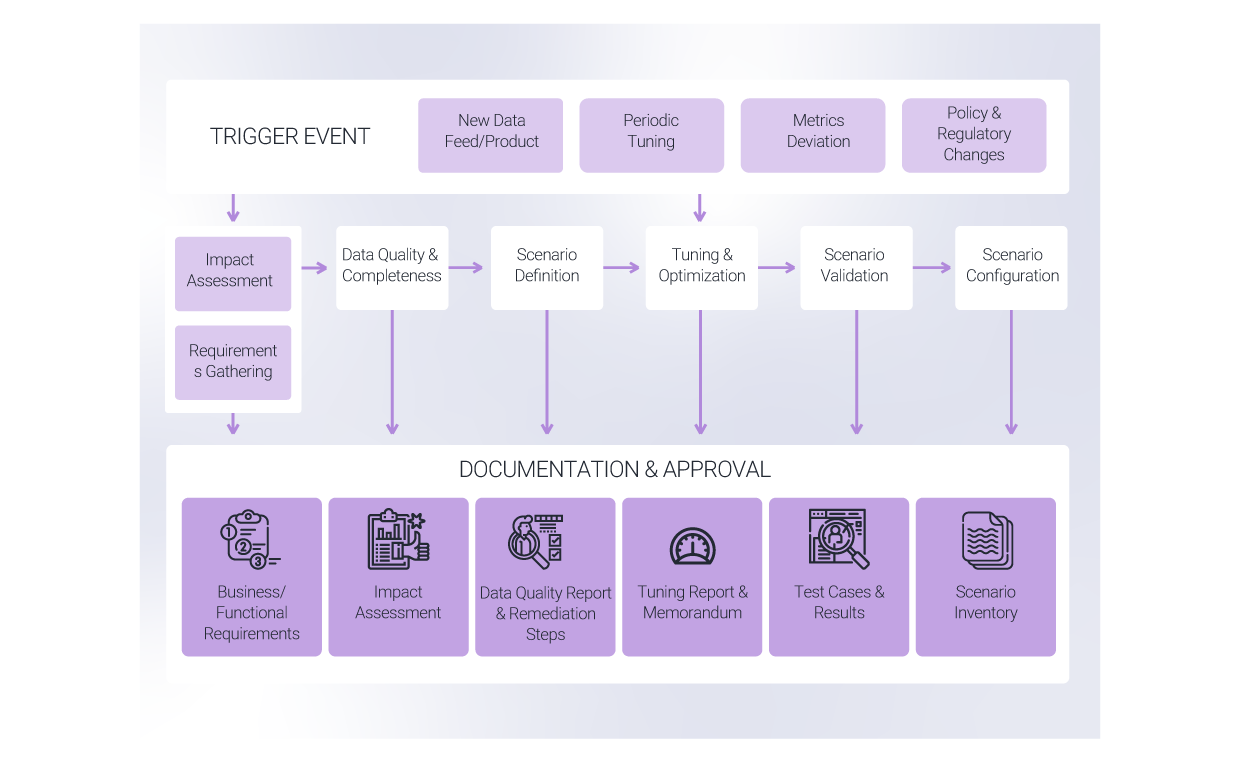

There is a plethora of tools currently on the market that provide automated transaction monitoring and machine learning capabilities. Often, the transaction monitoring program is not relevant to the overall BSA/AML risks faced by the bank, is outdated, or incorrectly calibrated. Some reasons for this misalignment are that the transaction monitoring program has not been revisited or reviewed since its implementation or BSA/AML risk assessment review.

As risk assessments are typically conducted on an annual basis, they are often updated only when a “major event” occurs, such as a merger or acquisition; exponential growth in a new market area; introduction of a new product or service; and/or significant changes in the regulatory environment that could impact a financial institution. A financial institutions’ policies and procedures, such as the risk assessment, should clearly detail the downstream impact created by these “major events.”

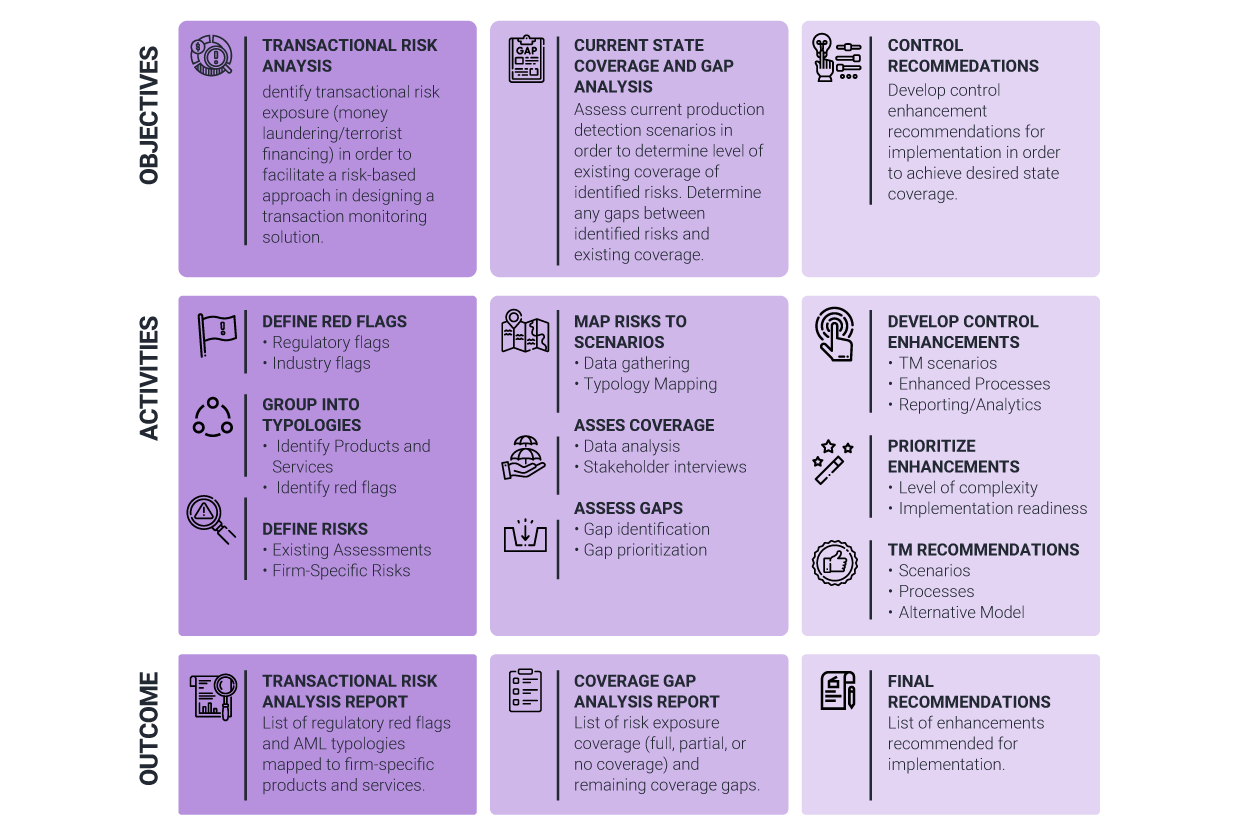

Changes to a risk assessment should also trigger an independent risk coverage assessment to be revisited for its applicability, which could further warrant a fresh round of rule scenario tuning exercises; a coverage assessment is a deep-dive analysis of the conceptual soundness of the model, a firm’s risk exposure, and risk coverage. The assessment determines if there are any gaps in coverage that exposes the firm to suspicious activity and/or deficiencies in regulatory guidance. Some examples of what the assessment reviews includes AML typologies, current rule scenarios, and coverage for “red flags” listed by the regulators.

Regulators are looking for financial institutions to implement an effective risk-based approach within their BSA/AML Compliance program, and it is the responsibility for the financial institution to have sufficient controls when reviewing their overall risk profile on a periodic basis. Demonstrating that they have thorough knowledge of the risks associated with their products, geographies, and customers from both a qualitative and quantitative perspective becomes a priority especially given the dynamic and fast changing environment. This understanding is fundamental for financial institutions to define and manage an effective BSA/AML program that limits exposure to risks associated with money laundering and terrorist financing. Matrix-IFS provides advisory services to some of the largest financial institutions in the world such as: Deutsche Bank, UBS, Rabo Bank, Mega Bank, Interaudi Bank, and many more. Here are some of the testimonies we received from our clients:

Matrix-IFS has not only helped global top-tier financial institutions implement and upgrade their risk, fraud, and compliance solutions, but is a recognized partner of Actimize, Oracle, SAS, FISERV, BAE Systems, Bottomline, and Pitney Bowes. Additionally, Matrix-IFS developers also have hands-on experience implementing out-of-the-box rule scenarios and creating custom rule scenarios that match the customer type and risk profile for these institutions. As part of every implementation project, the Matrix-IFS engagement team also creates documentation, conducts user testing, and provides training and knowledge transfer to the client’s business and technical teams. Matrix-IFS also offers proprietary tools as additional services that assist with threshold tuning for Actimize and Mantas rule scenarios, country code tool for improving geolocation on transactional data, and red flags library for assessing risk coverage. This coverage assessment framework allows for the easy identification of applicable red flags/typologies based on the products and services offered, customer types served, and geographies operated in for each financial institution.

Extending AML Regulations to Investment Advisors

On August 28, 2024, the Financial Crimes Enforcement Network (FinCEN) issued a final rule that extends Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) requirements to Registered Investment Advisers (RIAs) and Exempt Reporting Advisers (ERAs). This rule, effective January 1, 2026, mandates that RIAs and ERAs develop and implement comprehensive AML/CFT programs, aligning them with other financial institutions under the Bank Secrecy Act (BSA).

2024 Year in Review: Financial Crime Compliance, and Regulatory Trends

In 2024, regulatory enforcement increased, financial crime risks evolved, and scrutiny of both traditional and emerging financial institutions heightened. As regulatory bodies worldwide intensify their focus, organizations must adapt to a rapidly changing compliance landscape.

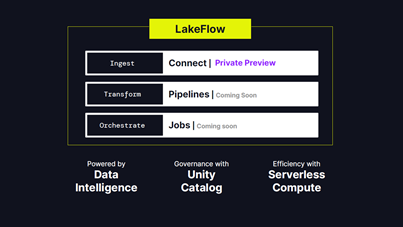

Databricks 2024 Developments and Announcements

The global Databricks Data + AI conference held two weeks ago in San Francisco included a long list of innovations and announcements. Unlike last year, this year Snowflake and Databricks held their conferences in the same conference hall (Snowflake first and Databricks a week later), giving data professionals and enthusiasts the opportunity to catch up, learn and attend an action-packed couple of weeks of announcements, expert presentations and networking..

Cloud AI and RPA

The fight against financial crimes has been on for decades. Do you remember Michael Night? Those of us who grew up in the good old days of the 80s were probably huge fans of the American action crime drama TV series, Knight Rider.

FINTRAC’s requirements – Armored cars

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada’s financial intelligence unit and anti-money laundering and anti-terrorist financing supervisor. Its mandate is to facilitate the detection, prevention and deterrence of money laundering and the financing of terrorist activities, while ensuring the protection of personal information under its control.

Using Generative AI in Combating Financial Crimes

Amazon recently launched a feature where hundreds, and sometimes thousands, of reviews are summarized into a concise and simple paragraph. This auto-generated summary allows the customer to instantly get an overall review of a product’s capabilities as well as overall customer satisfaction. This is a great example of using Large Language Models (LLM) to process and produce text that resembles that of humans. These models can understand language structures, grammar, context, and semantic linkages since they have been trained on enormous amounts of text data.

Evolution of DeFi Amid Regulatory Uncertainty

Emerging technologies are reshaping the financial services industry. On one end of the spectrum, initiatives such as Real-Time Payments and ISO20022 are modernizing existing payment infrastructure, making it faster and more efficient. On the other end, blockchain and distributed ledger technologies (DLT) are laying the foundation for an alternative ecosystem involving digital assets and cryptocurrencies.

Balance Open Banking Enthusiasm with Caution

Digitalization and Open Banking are two most prominent trends in banking industry in recent time. While the former was initiated by changing customer behavior, the latter was driven by regulatory and market forces.

Open Banking is a new kid on the block with a lot of promise and fanfare, but it can present new challenges for financial services. Rather than being swayed by its exuberance, a cautious approach is required for its implementation.

Combating Fraud – A Journey From Good to Great

Financial Institutions are in a similar situation. A lot has changed in the last few years. Fraud activities and losses are on the rise. FIs need to act or face the consequences – higher fraud losses, loss of public trust and declining customer loyalty. Given the risk, it is imperative that risk leaders adjust their fraud strategies to adapt to the new reality.

Banking & Compliance Post Pandemic

Traditional banking and the wind of change are not inherently linked, but now more than ever, it seems that the change offered by modern technology is not only adopted, but due to the pandemic is happening at an accelerated pace. From the demand for more speedy processes, through the increased trend of closing branches, and all the way to new possibilities that the digital arena offers (including AI and Machine Learning). All this without even mentioning Crypto and the challenges it posts to traditional banks. Weather we like it or not, change is all around us. Here are some highlights from our recent webinar where we discussed banking and compliance post pandemic:

Understanding Economic Sanctions

Imposing economic sanctions is a powerful foreign policy tool used by countries and international organizations that can include travel bans, asset freezes, arms embargoes, and trade restrictions with countries, individuals, and entities. The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) “administers and enforces economic and trade sanctions based on US foreign policy and national security goals.” The names of individuals, entities, aircraft, vessels, and countries are incorporated into OFAC’s list of Specially Designated Nationals and Blocked Persons (“SDN list”), which blocks U.S. persons from transacting with both them and their assets. The SDN list is updated ad-hoc, with new additions to and removals from the list.

Modern Challenges and Innovative Tools for Sanctions Compliance

Financial institutions need to meet growing sanctions compliance demands without disrupting customer services, incurring an exorbitant overhead, and being exposed to regulatory fines.

Matrix-IFS and Quantifind Partner to Complement Financial Crimes Solutions and Services

Quantifind, a provider of a SaaS platform used by banks to help automate financial crimes risk screening and investigations, today announced its partnership with Matrix-IFS, the leading provider of financial crime advisory and implementation services. Quantifind’s Graphyte™ platform brings best-in-class risk assessment and entity resolution accuracy to Matrix-IFS’ comprehensive services for KYC/CDD/EDD, transaction monitoring, sanctions screening, and case management. Graphyte includes integrations with leading case management platforms that seamlessly incorporate advanced risk intelligence directly within analysts’ familiar tools and workflows.

The Benefits of AML Cloud Convergence – AML as a Service

Many Chief Compliance Officers at midsized financial institutions sense that streamlining their anti-money laundering systems will lead to increased efficiency and effectiveness across their AML programs, but they wonder where to start.

How Mid-sized FIs Can Turn 3 Industry Trends into AML Opportunities

Midsized financial institutions (with $1 billion – $10 billion in assets) play an important role in our financial system, especially in the U.S. where banks with less than $10 billion in assets represent 14% of the market and 97% of the total number of banks.

Step 3 – Entity Resolution (Account Matching & Linking)

Welcome back to Matrix AML Academy. In case you missed our previous post, this is the 3rd part of an 8-part educational program on how to improve tour AML program and systems

Step 2 – Proactive Data Quality Automation

Welcome back to Matrix AML Academy. In case you missed our previous post, this is the 2nd part of an 8-part educational program on how to improve tour AML program and systems

Step 1 – Transaction Monitoring Implementation Best Practices

Welcome to Matrix Academy! A place you can hone in on your AML skills, gain valuable knowledge, learn insider tips of the trade and keep up to date with current technologies and methods

COVID-19 Cyber Security Risks & Remedies

As COVID-19 continues to spread, phishing lures related to the CoronaVirus continue to appear. Some instances of “Casebaneiro Banking Trojan”, “HawkEye” and “WSH RAT” all using COVID-19 in phishing lures or executable names were spotted.

The NY DFS 500 Cyber Security Regulation Requirements Checklist

The New York State Department of Financial Services (“DFS”) has been closely monitoring the ever-growing threat posed to information and financial systems by nation-states, terrorist organizations and independent criminal actors.

Matrix-IFS Expands Its Financial Crime Advisory Practice

Matrix-IFS, a specialized financial crime and compliance solution provider, announces the expansion of its Advisory Services with the acquisition of a leading NYC-based Advisory consulting firm, Alius.

Matrix-IFS Named “10 Most Trusted Risk Management Solution Providers” in 2019

With millions of accounts containing people’s life savings, security has always been one of the largest concerns for financial institutions and their customers. As cybercriminals become more sophisticated in their hacking techniques, institutions should adopt more advanced cybersecurity and fraud prevention systems. Although new technologies provide more advanced security options, knowing which ones to use and how to implement them is a challenge many institutions face today.

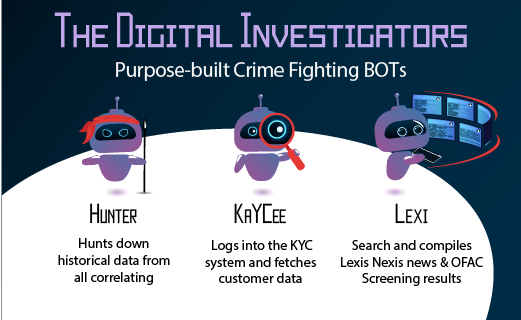

Hunter – The Historical Transaction Lookup Digital Investigator (RPA BOT)

Looking up historical transaction data is a task every Investigator knows and dreads; constantly going to the upstream data systems, collecting historical data, merging it, only to try and make sense how the customer behavior looks like. Imagine a world where he wouldn’t have to do all that and simply focus on investigations. Sounds like a dream, right? Not anymore. With Robotics Process Automation it is now a reality, one that could easily and quickly be adapted.

Unveiling Hunter, Kaycee & Lexi – AKA, the Digital Investigators

On October 10th, we had the honor of speaking at the European Banking Forum in London in front of 100 compliance & financial crime Senior Managers, where we announced our purpose-built Digital Investigators into the world.

A Word About Cost Conscious Compliance

Last week, we had the honour and pleasure to engage in a fruitful conversation with a roomful of Compliance leaders from the financial sector, to share ideas and findings as to practical approaches to reducing compliance overheads.

Crime Tourism – ATM Skimming Operations

We’ve all been there, choosing our next travel destination. What should be a fun and exciting experience, can sometimes be stressful and overwhelming as there are many factors that can impact on our choice of a travel destination, to name a few: budget, travel companions, timing, weather and popular attractions.

Matrix-IFS is Sponsoring ACAMS Europe in Berlin (June 12-13 )

On June 12th, Matrix-IFS will be taking part in one of the most prestigious Financial Crime Conferences in Europe – ACAMS Europe, which will take place at the Berlin Congress Center GmbH. This 2-day conference brings together vendors, industry thought leaders and various financial institutions from across Europe.

The 5th AML Directive Readiness Checklist

During 2019-2020, EU countries will pass laws that introduce the 5th AML Directive (5MLD) into their respective national laws. Now is the time for your organization to invest in improving and optimizing your existing AML solutions to meet the increased challenges and regulator demands before it’s too late.

Best Practices to Transaction Monitoring Implementation

There are four key phases in transaction monitoring (TM) implementations and how a bank should design and execute these phases. Successful implementation of rule selection, data prep, segmentation, tuning and operational optimization will determine the success of the overall TM implementation in your organization.

Matrix-IFS is Attending ACAMS Florida (April 15-17)

On April 15–17 Matrix-IFS will be taking part in one of the largest Financial Crime Conferences in the US – ACAMS Florida, which will take place at the Diplomat Resort & Spa in Hollywood, Florida. This 3-day conference brings together vendors, industry thought leaders and various financial institutions from across the world.

The Problem with AML Today & How to Fix It: Part I – The AML Problem

The latest discoveries around the massive scale of money laundering at Danske Bank and ING are just two of the most recent examples of an underlying problem with the Anti-Money Laundering (AML) discipline. Despite increasing efforts and investments focusing on the AML problem, money laundering techniques continue to evolve and evade the controls implemented by Financial Institutions (FIs). More and more industry voices decry the efficiency and effectiveness of the current AML approach – which entails running all transactions through a series of automated checks to spot anomalies based on a large set of pre-defined typologies provided by experts.

Applying Robotic Process Automation in AML & FIU Operations

Learn how RPA can increase efficiency, lower risk, and trim your overhead

Matrix-IFS Hosts 4 Anti-Financial Crime Webinars

Matrix-IFS introduces a series of timely and informative webinars on new issues, trends and solutions in Anti-Financial Crime. Webinars are designed to update and inform risk, compliance, control room and fraud professionals working in financial institutions and capital markets.

Supercharge your FIU’s Operations with RPA at ACFE Las Vegas

During The 29th Annual ACFE Global Fraud Conference Anshul Arora , Head of FL Delivery Center will present Matrix-IFS’s RPA solution for improved operations and increased efficiency. During his session, Anshul will explore a new vision of a modern FIU department, which incorporates Artificial Intelligence, Machine Learning and advanced analytics to address and reduce alerts as well as how robotics and automation can play part in reducing risk and simplifying the work of the Investigators.

Top 6 Deal / List Systems Challenges and How to Solve Them

You know the challenges associated with your Deal Management (DMS) and List Management (LMS) systems & processes. You may even be aware of the full burden and cost they pose to your department and your organization. Now benefit from the fresh approach firms are taking with their Deal and List Management systems to gain efficiency and save time and resources.

How to Overcome AML Operations Growing Pains Using Cutting-edge Technology? | Find Out at ACAMS Europe

During ACAMS Annual Europe Conference taking place 30 May – 1 June in Amsterdam, Matrix-IFS will participate in a panel session on the subject of AML Operations and how to fight growing pains using cutting-edge technology where we will share options to enhance performance by replacing limiting rule-based solutions with far more efficient intelligent solutions that operate within existing infrastructure.The panel will discuss combining Graph Analytics, AI/Machine Learning, and Scenario Authoring on big data to improve the quality of detection, prevention and reporting of financial crimes.

Future-Proofing Financial Crime Compliance: A Technology Blueprint for Smarter Risk Management

The evolution of threats to the financial system is outpacing advancements in Financial Crime Compliance (FCC) regulations and technology used by financial institutions (FI). In this situation, FI can save considerable funds, by creating or evolving their business architecture with a view of adapting to emerging threats and the advanced tech that will be required to tackle them.

Matrix-IFS Named “Top 10 Risk & Compliance Solution Providers 2018”

Since 2006, Matrix International Financial Services (Matrix-IFS) has been helping financial institutions strengthen business compliance and address financial crimes and fraud issues, with a goal to satisfy both regulators and clients with effective, efficient and cost-effective solutions.

Deciphering Multi-Faceted Venezuelan Sanctions – Top Ten Practical Tips to Stay Compliant

The recently imposed Venezuelan sanctions issued by the U.S., the E.U., and Canada have placed heavy burdens on sanctions compliance programs. This has made it…

Quick answers. Real solutions.

Let’s Connect and Explore How We Can Help

Fill out the form and our team will get back to you shortly.

Quick answers. Real solutions.

Let’s Connect and Explore How We Can Help

Fill out the form and our team will get back to you shortly.

Thank you!

Thank you!

Please submit your details