| Country / Organization | Sanctions Against Venezuela |

|---|---|

| U.N. | No |

| E.U. | Yes |

| U.K. | Yes (follows E.U.) |

| U.S. | Yes |

| Mexico | Yes (follows U.S.) |

| Canada | Yes |

Deciphering Multi-Faceted Venezuelan Sanctions – Top Ten Practical Tips to Stay Compliant

18.06.2024

18.06.2024

16 min read

16 min read

Deciphering Multi-Faceted Venezuelan Sanctions – Top Ten Practical Tips to Stay Compliant

The recently imposed Venezuelan sanctions issued by the U.S., the E.U., and Canada have placed heavy burdens on sanctions compliance programs. This has made it much more difficult for companies and financial institutions who engage in business with the troubled South American nation to stay compliant.

Not only are these new sanctions on Venezuela detailed, multilateral, multi-faceted, and yet to be properly defined, but designated entities (or those businesses connected to them) are not always easily identifiable.

Many compliance suites are having trouble navigating these muddy waters.

U.S. Sanctions Against Venezuela–‘Off Limit’ Bonds

On March 8, 2015, former-President Obama issued targeted sanctions against Venezuela by Executive Order (E.O.) 13692, which blocked property and suspended entry of certain officials of the Venezuelan government, including President Maduro, and other senior government and military officials. The Trump Administration followed suit in January 2017 by imposing further targeted sanctions against Venezuela, such as designations of the country’s Vice President, a chief judge, and several other Supreme Court judges.

The real compliance challenges, however, started in August 2017. While many compliance officers were enjoying vacations with their families, the U.S. issued E.O. 13808, imposing so-called “debt sanctions”, which prohibits U.S. persons from engaging in any transactions or dealings involving “new” debt of certain maturity durations of the Government of Venezuela and the country’s oil giant – Petroleos de Venezuela, S.A. (PdVSA). It also prohibits dealings in some existing debt of the government as well as any “new” equity of government-owned entities, such as PdVSA, along with the paying dividends or other profits back to the government from government-owned entities. For existing debt and equity, such as that of PdVSA, the U.S. has carved out a narrow exemption by granting a general license.

In essence, the U.S. government has made a set of bonds “off limits” from one day to another. As such, these sanctions have had sweeping ramifications for every facet of a financial institution’s compliance structure.

Other Sanctions Against Venezuela

For sanctions compliance professionals working at organizations with operations outside the U.S., it’s important to know which other countries have also issued sanctions against Venezuela.

The European Union issued their own sanctions program in 2017, deepening their crackdown on Venezuela and Maduro’s alleged abuses of human rights.

The U.K., as a (still) member of the E.U.,followed suit with E.U. sanctions and passed the Venezuela (European Financial Sanctions) Regulations 2017, which came into force on December 6, 2017.

Canada issued targeted sanctions against senior Venezuelan officials in September 2017.This broad ban under the Special Economic Measures Act (“SIMA”), prohibits engaging in activities with President Nicolás Maduro and other listed individuals alleged to be undermining the democracy of Venezuela.

The United Nations do not currently have a sanctions regime against Venezuela. Thus, unless a UN member state issues their own autonomous sanctions regime against Venezuela, no sanctions are in place.

The Mexican government, referring to the U.S. sanctions against Venezuela in a communique on July 27, 2017, said that it would proceed “in conformity with the applicable laws and treaties.”

Country / OrganizationSanctions Against VenezuelaU.N.NoE.U.YesU.K.Yes (follows E.U.)U.S.YesMexicoYes (follows U.S.)CanadaYes[/vc_column_text]

| Country / Organization | Sanctions Against Venezuela |

|---|---|

| U.N. | No |

| E.U. | Yes |

| U.K. | Yes (follows E.U.) |

| U.S. | Yes |

| Mexico | Yes (follows U.S.) |

| Canada | Yes |

Practical Tips to Stay Compliant

In order to assist compliance suites with this increasingly complex regime, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) has issued multiple FAQ’s. OFAC FAQs have been vital in understanding how to interpret the rules when dealing with Venezuelan transactions.

Nevertheless, five months after “debt sanctions” against Venezuela were issued, there is still a great deal of confusion among sanctions compliance officers about how to best comply. Many are still uncertain about what activity is covered, as well as what transactions are allowed or prohibited with regard to particular individuals or companies associated with the government of Venezuela. Some financial institutions have opted to play it “safe” and shut all business with Venezuela down.

Any misinterpretations of the complex sanctions regimes against Venezuela could carry a hefty fine. In order to assist, SanctionsAlert.com has interviewed legal and compliance experts in order to provide a ‘Top Ten’ list of practical tips on how to best tackle the Venezuelan sanctions regimes and to give your business the best chance of staying compliant.

Practical Tip 1 –Evaluate Your Level of Exposure and Risk

If you are going to continue to operate in Venezuela, the first step in identifying any compliance hurdles is for firms to determine their individual risk exposure and risk appetite.

A good starting point is “KYS” – Know Your Sanctions: Know exactly what is prohibited under the sanctions regime. For example, when OFAC issued the debt sanctions in August 2017, it also issued “General License 3”. This license permitted certain activity concerning bonds that would otherwise be prohibited. The license listed 70+ types of bonds that were permissible to trade and to hold, however, it did not initially identify which bonds were actually prohibited until about one week later,when OFAC issued a clarification about the nature of the prohibited bonds. As it turned out, they were not that common. In such a scenario, a financial institution, in an effort to comply swiftly, may have gone on an elaborate hunt for prohibited bonds and found out a week later, that this time-consuming and costly exercise had been premature.

Next step is to Know Your Customer (KYC), or determine a firm’s risk exposure by examining its client base, distributors, and partners. In order to do this, it is important to assess the adequacy of your existing KYC documentation as well as any connections that the firm may have with Venezuela, including any indirect links. It may be that some firms have no Venezuelan exposure, while some firms engage in business with Venezuela regularly. Each firm must determine its own risk appetite on an individual basis.

Most importantly, once risk appetite is identified, a firm must decide whether or not they have the resources at hand to deal with that risk.

Practical Tip 2- Identify Beneficial Owners

This may be harder than it sounds in many situations as those trying to evade sanctions can be very crafty in covering, or layering, their tracks. According to Debra Geister, Managing Director of AML Advisory Services at consulting firm Matrix International Financial Services (IFS), “just like the Russian or North Korean sanctions, identifying any business in those jurisdictions presents a unique set of challenges. It puts additional burdens on the KYC/EDD teams to further dig into the potential underlying relationships of customers in those regions”. “It also presents challenges for correspondent banking or internal clearing for global banks”, she adds.

Firms should think logically about what types of business could be linked to Venezuela in consideration of their major industries and exports.

“Similar to the issues we saw with North Korean sanctions”, explains Ms. Geister, “there are challenges from the banks perspective to identify the beneficial owners of any entities that you may be doing business with. This layering to evade sanctions is something that definitely will occur. Venezuela is heavily involved in oil, gas and natural resources so any types of companies would be involved in those mining and exploration industries would be those I would target as higher risk, especially if they are doing business in the Latin American (LATAM) region”.

“We have to dig to identify those beneficiaries”, emphasizes Ms. Geister.

Practical Tip 3- Think Like the ‘Bad Guys’

Firms should also be prepared for sanctions violators to go to great lengths to evade sanctions.As such, compliance professionals should adopt the approach of trying to view a transaction in the eyes of the violator.

“A corrupt regime, such as the one in Venezuela, will look to evade sanctions”, claims Ms Geister. In order to be able to effectively identify suspicious entities and owners, a firm must always step‘into the shoes’ of those trying to evade sanctions in order to best identify suspicious entities and transactions.

“Try to put yourself in the position of having to evade detection. Think like the bad guys”, advises Ms. Geister. “Sanctions create large challenges and threats to a country’s economy. The stakes are high. Think about scenarios that would help you evade those controls. Based on experience, some of these entities go to great lengths to find ways around the sanctions. You want to make sure they are not doing it on your watch through your brand,” she warns.

Practical Tip 4 – Don’t Forget about Cryptocurrencies

In order to effectively identify suspicious transactions, it is necessary to go beyond the usual best practices of transaction monitoring and actively search for novel ways to identify those who may be trying to evade sanctions.One new way that sanctioned regimes, like Venezuela, are managing to evade sanctions is through the use of virtual currencies, or so-called cryptocurrencies.

“We were able to identify a scheme to move money using virtual currencies by creating a query of currency exchanges attached to accounts that were transacting in sanctioned jurisdictions”, says Ms. Geister.“Because we knew that these countries were trying to maneuver around the sanctions, we ended up finding a large number of accounts that were not only moving funds through virtual currencies to sanctioned countries, they were structuring those funds at high velocity”, she adds.

In fact, Venezuela is looking to create their own state-sponsored virtual currency called ‘Petro’, which could potentially help the country to evade sanctions by positing a financial infrastructure outside the control of any central authority.

On January 19, OFAC clarified in their FAQs that: “A currency with these characteristics would appear to be an extension of credit to the Venezuelan government. Executive Order 13808 prohibits U.S. persons from extending or otherwise dealing in new debt with a maturity of greater than 30 days of the Government of Venezuela. U.S. persons that deal in the prospective Venezuelan digital currency may be exposed to U.S. sanctions risk.”

Practical Tip 5 – Look to Similar Sanctions Regimes for Interpretive Clues

Though the new Venezuelan sanctions regime can seem very daunting, it is by no means the first of its kind. It can be a good idea to examine preceding sanctions regimes, such as those imposed on North Korea and Russia, for clues on how OFAC will interpret the Venezuelan regime.

Peter Jeydel, Associate at Steptoe & Johnson LLP in Washington, D.C., says that, “OFAC’s Venezuela sanctions program shares a lot of features in common with the Russia/Ukraine primary sanctions program. It can often be instructive to look to the Russia/Ukraine program for guidance on how OFAC may apply “new debt” prohibitions in the Venezuela context”.

In relation to sanctions against Russia, OFAC has thus far construed the term ‘new debt’ very broadly to include not only bonds, but also virtually any extension of credit. This can include loans and even payment terms in commercial transactions.

That being said, Mr. Jeydel goes on to extend a word of caution: “Although there are important differences between those programs, so one should not assume that Russia/Ukraine-related guidance necessarily will apply in the Venezuela context.”

Practical Tip 6 – Make Use of PEP Lists

As any good compliance professional will tell you, identifying suspicious transactions does not start and end with OFAC’s SDN List. There are many other lists that can be indicative of a higher risk individual. One of these lists is the Politically Exposed Persons (PEP) List.The Financial Action Task Force (FATF), a standard- setting body for money laundering, defines a PEP as “an individual who is or has been entrusted with a prominent public function.”

Ms. Geister tells us that, “PEP lists are one of the best tools we have to identify those sanctioned entities and also those that have any connection to them”.

These lists can be especially useful in identifying suspicious individuals and their connected entities when dealing with a corrupt regime, such as the one in Venezuela.

Practical Tip 7 –For EU Compliance Officers, U.S. Rules Could Provide Clues

Though the E.U. has also recently cracked down on Maduro’s government, individuals and entities are yet to be designated. Nadiya Nychay, Partner at Dentons in Brussels, believes there may be some merit for E.U. compliance professionals in staying on top of U.S. designations.

The E.U. foreign ministers imposed economic sanctions and arms embargo, on Venezuela on November 13, 2017, in response to the ongoing humanitarian crisis in the struggling South American state (EU Council Regulation 2017/2063).

Ms. Nychay says that,“The EU recently made its first Venezuelan smart sanctions designations. The seven people designated – all high-level Venezuelan officials – were sanctioned for, among other things, human rights violations (including torture) and undermining the rule of law in Venezuela.From a practitioner’s perspective, it is notable that six out of these seven have already been named Specially Designated Nationals under the US’ Venezuelan sanctions program. This suggests a high-level of coordination between the EU and US, and that future EU and US Venezuelan designations can be anticipated to hew closely to one another. Continued harmonization between the two regimes will be valued by international companies active in both jurisdictions, as it will simplify sanctions compliance across the corporate group.”

Practical Tip 8 – Invest in Transaction Monitoring

If nothing else, the new Venezuelan sanctions have greatly increased the number of alerts that are being received by compliance professionals doing business in the LATAM region on a daily basis.

For those institutions that identify a moderate to high-risk appetite with regard to Venezuela, it may be time to think about investing in a transaction monitoring system to help in identifying suspicious transactions. Most experts say that the added costs of having such a system are greatly outweighed by the value it brings to their firm as a whole, as well as to their day-to-day work.

Now more than ever, the market is littered with products that can help to identify sanctioned entities, and it may be advisable for firms that have any exposure to sanctioned businesses or countries to look into a tool that can assist.

Practical Tip 9–Keep Alert for Future Designations

Unlike some other sanctions regimes that are likely to stay static for the time being, Venezuelan sanctions may change in the near future, and not for the better.The U.S. government has already declared its intention to extend and broaden sanctions against the South American country and compliance suites would be wise to take heed.

“If they aren’t sanctioned this week, odds are they will be next week”, warns Vanessa Neumann, President of counter-threat finance consultancy – Asymmetrica – and author of “Blood Profits.”

“As the situation in Venezuela becomes ever more dire, we can anticipate an increasing use of the Global Magnitsky Act, which has enormous powers to to impose financial sanctions and visa restrictions on foreign persons in response to certain human rights violations and acts of corruption. That is in addition to Kingpin Act sanctions, which we can also expect to see more of, as the regime becomes ever more desperate for alternate forms of financing,” she adds.“In short, business with Venezuela, while the Maduro regime remains in power, will prove a major challenge for compliance officers.”

Practical Tip 10 – Don’t Forget Canadian Lists

So far, Canada’s economic sanctions against Venezuela have been restricted to listed persons measures. On September 22, 2017, under SIMA, Canada imposed a broad ban on engaging in activities with President Nicolás Maduro and 39 other listed individuals alleged to be involved in undermining the security, stability or integrity of democratic institutions of Venezuela.

On October 18, 2017, Canada’s Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law) came into force, allowing for the first time sanctions to be applied to foreign nationals considered to be responsible for or complicit in gross violations of human rights or acts of significant corruption. On November 3, 2017, a list was established under the Sergei Magnitsky Law identifying 52 foreign nationals; these included President Maduro and 18 other Venezuelan officials, some of whom were already listed under the SIMA measures.

“Although at the present time, there are no general prohibitions on doing business with Venezuela or certain sectors of the Venezuelan economy, firms doing business abroad should be screening their counter parties against these and other sanctions lists to ensure they do not engage in any dealings with these listed persons and the entities they own or control,” says John Boscariol, Partner at McCarthy Tétrault in Canada.

Extending AML Regulations to Investment Advisors

On August 28, 2024, the Financial Crimes Enforcement Network (FinCEN) issued a final rule that extends Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) requirements to Registered Investment Advisers (RIAs) and Exempt Reporting Advisers (ERAs). This rule, effective January 1, 2026, mandates that RIAs and ERAs develop and implement comprehensive AML/CFT programs, aligning them with other financial institutions under the Bank Secrecy Act (BSA).

2024 Year in Review: Financial Crime Compliance, and Regulatory Trends

In 2024, regulatory enforcement increased, financial crime risks evolved, and scrutiny of both traditional and emerging financial institutions heightened. As regulatory bodies worldwide intensify their focus, organizations must adapt to a rapidly changing compliance landscape.

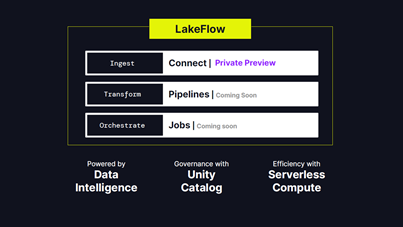

Databricks 2024 Developments and Announcements

The global Databricks Data + AI conference held two weeks ago in San Francisco included a long list of innovations and announcements. Unlike last year, this year Snowflake and Databricks held their conferences in the same conference hall (Snowflake first and Databricks a week later), giving data professionals and enthusiasts the opportunity to catch up, learn and attend an action-packed couple of weeks of announcements, expert presentations and networking..

Cloud AI and RPA

The fight against financial crimes has been on for decades. Do you remember Michael Night? Those of us who grew up in the good old days of the 80s were probably huge fans of the American action crime drama TV series, Knight Rider.

FINTRAC’s requirements – Armored cars

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada’s financial intelligence unit and anti-money laundering and anti-terrorist financing supervisor. Its mandate is to facilitate the detection, prevention and deterrence of money laundering and the financing of terrorist activities, while ensuring the protection of personal information under its control.

Using Generative AI in Combating Financial Crimes

Amazon recently launched a feature where hundreds, and sometimes thousands, of reviews are summarized into a concise and simple paragraph. This auto-generated summary allows the customer to instantly get an overall review of a product’s capabilities as well as overall customer satisfaction. This is a great example of using Large Language Models (LLM) to process and produce text that resembles that of humans. These models can understand language structures, grammar, context, and semantic linkages since they have been trained on enormous amounts of text data.

Evolution of DeFi Amid Regulatory Uncertainty

Emerging technologies are reshaping the financial services industry. On one end of the spectrum, initiatives such as Real-Time Payments and ISO20022 are modernizing existing payment infrastructure, making it faster and more efficient. On the other end, blockchain and distributed ledger technologies (DLT) are laying the foundation for an alternative ecosystem involving digital assets and cryptocurrencies.

Balance Open Banking Enthusiasm with Caution

Digitalization and Open Banking are two most prominent trends in banking industry in recent time. While the former was initiated by changing customer behavior, the latter was driven by regulatory and market forces.

Open Banking is a new kid on the block with a lot of promise and fanfare, but it can present new challenges for financial services. Rather than being swayed by its exuberance, a cautious approach is required for its implementation.

Combating Fraud – A Journey From Good to Great

Financial Institutions are in a similar situation. A lot has changed in the last few years. Fraud activities and losses are on the rise. FIs need to act or face the consequences – higher fraud losses, loss of public trust and declining customer loyalty. Given the risk, it is imperative that risk leaders adjust their fraud strategies to adapt to the new reality.

Banking & Compliance Post Pandemic

Traditional banking and the wind of change are not inherently linked, but now more than ever, it seems that the change offered by modern technology is not only adopted, but due to the pandemic is happening at an accelerated pace. From the demand for more speedy processes, through the increased trend of closing branches, and all the way to new possibilities that the digital arena offers (including AI and Machine Learning). All this without even mentioning Crypto and the challenges it posts to traditional banks. Weather we like it or not, change is all around us. Here are some highlights from our recent webinar where we discussed banking and compliance post pandemic:

Understanding Economic Sanctions

Imposing economic sanctions is a powerful foreign policy tool used by countries and international organizations that can include travel bans, asset freezes, arms embargoes, and trade restrictions with countries, individuals, and entities. The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) “administers and enforces economic and trade sanctions based on US foreign policy and national security goals.” The names of individuals, entities, aircraft, vessels, and countries are incorporated into OFAC’s list of Specially Designated Nationals and Blocked Persons (“SDN list”), which blocks U.S. persons from transacting with both them and their assets. The SDN list is updated ad-hoc, with new additions to and removals from the list.

Modern Challenges and Innovative Tools for Sanctions Compliance

Financial institutions need to meet growing sanctions compliance demands without disrupting customer services, incurring an exorbitant overhead, and being exposed to regulatory fines.

Navigating Emerging Risks and Regulatory Changes with a Robust AML Compliance Program

Regulators have fined financial institutions close to 20 billion dollars for Anti-Money Laundering (AML) shortcomings and regulatory violations in the last 6 years.

Matrix-IFS and Quantifind Partner to Complement Financial Crimes Solutions and Services

Quantifind, a provider of a SaaS platform used by banks to help automate financial crimes risk screening and investigations, today announced its partnership with Matrix-IFS, the leading provider of financial crime advisory and implementation services. Quantifind’s Graphyte™ platform brings best-in-class risk assessment and entity resolution accuracy to Matrix-IFS’ comprehensive services for KYC/CDD/EDD, transaction monitoring, sanctions screening, and case management. Graphyte includes integrations with leading case management platforms that seamlessly incorporate advanced risk intelligence directly within analysts’ familiar tools and workflows.

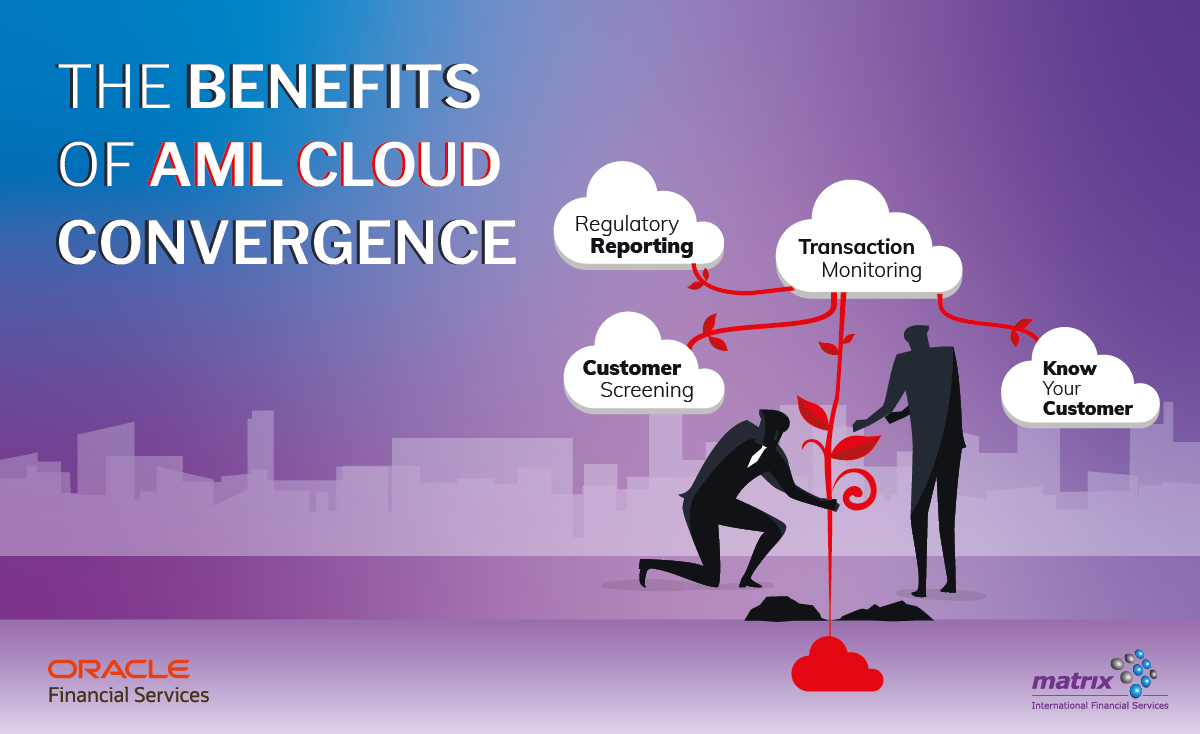

The Benefits of AML Cloud Convergence – AML as a Service

Many Chief Compliance Officers at midsized financial institutions sense that streamlining their anti-money laundering systems will lead to increased efficiency and effectiveness across their AML programs, but they wonder where to start.

How Mid-sized FIs Can Turn 3 Industry Trends into AML Opportunities

Midsized financial institutions (with $1 billion – $10 billion in assets) play an important role in our financial system, especially in the U.S. where banks with less than $10 billion in assets represent 14% of the market and 97% of the total number of banks.

Step 3 – Entity Resolution (Account Matching & Linking)

Welcome back to Matrix AML Academy. In case you missed our previous post, this is the 3rd part of an 8-part educational program on how to improve tour AML program and systems

Step 2 – Proactive Data Quality Automation

Welcome back to Matrix AML Academy. In case you missed our previous post, this is the 2nd part of an 8-part educational program on how to improve tour AML program and systems

Step 1 – Transaction Monitoring Implementation Best Practices

Welcome to Matrix Academy! A place you can hone in on your AML skills, gain valuable knowledge, learn insider tips of the trade and keep up to date with current technologies and methods

COVID-19 Cyber Security Risks & Remedies

As COVID-19 continues to spread, phishing lures related to the CoronaVirus continue to appear. Some instances of “Casebaneiro Banking Trojan”, “HawkEye” and “WSH RAT” all using COVID-19 in phishing lures or executable names were spotted.

The NY DFS 500 Cyber Security Regulation Requirements Checklist

The New York State Department of Financial Services (“DFS”) has been closely monitoring the ever-growing threat posed to information and financial systems by nation-states, terrorist organizations and independent criminal actors.

Matrix-IFS Expands Its Financial Crime Advisory Practice

Matrix-IFS, a specialized financial crime and compliance solution provider, announces the expansion of its Advisory Services with the acquisition of a leading NYC-based Advisory consulting firm, Alius.

Matrix-IFS Named “10 Most Trusted Risk Management Solution Providers” in 2019

With millions of accounts containing people’s life savings, security has always been one of the largest concerns for financial institutions and their customers. As cybercriminals become more sophisticated in their hacking techniques, institutions should adopt more advanced cybersecurity and fraud prevention systems. Although new technologies provide more advanced security options, knowing which ones to use and how to implement them is a challenge many institutions face today.

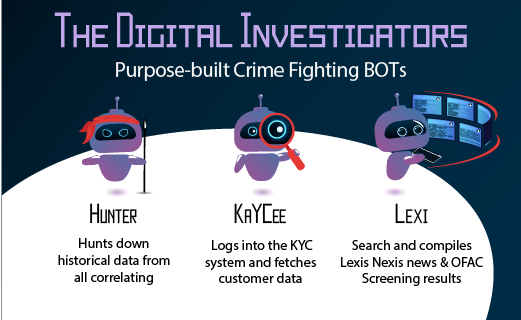

Hunter – The Historical Transaction Lookup Digital Investigator (RPA BOT)

Looking up historical transaction data is a task every Investigator knows and dreads; constantly going to the upstream data systems, collecting historical data, merging it, only to try and make sense how the customer behavior looks like. Imagine a world where he wouldn’t have to do all that and simply focus on investigations. Sounds like a dream, right? Not anymore. With Robotics Process Automation it is now a reality, one that could easily and quickly be adapted.

Unveiling Hunter, Kaycee & Lexi – AKA, the Digital Investigators

On October 10th, we had the honor of speaking at the European Banking Forum in London in front of 100 compliance & financial crime Senior Managers, where we announced our purpose-built Digital Investigators into the world.

A Word About Cost Conscious Compliance

Last week, we had the honour and pleasure to engage in a fruitful conversation with a roomful of Compliance leaders from the financial sector, to share ideas and findings as to practical approaches to reducing compliance overheads.

Crime Tourism – ATM Skimming Operations

We’ve all been there, choosing our next travel destination. What should be a fun and exciting experience, can sometimes be stressful and overwhelming as there are many factors that can impact on our choice of a travel destination, to name a few: budget, travel companions, timing, weather and popular attractions.

Matrix-IFS is Sponsoring ACAMS Europe in Berlin (June 12-13 )

On June 12th, Matrix-IFS will be taking part in one of the most prestigious Financial Crime Conferences in Europe – ACAMS Europe, which will take place at the Berlin Congress Center GmbH. This 2-day conference brings together vendors, industry thought leaders and various financial institutions from across Europe.

The 5th AML Directive Readiness Checklist

During 2019-2020, EU countries will pass laws that introduce the 5th AML Directive (5MLD) into their respective national laws. Now is the time for your organization to invest in improving and optimizing your existing AML solutions to meet the increased challenges and regulator demands before it’s too late.

Best Practices to Transaction Monitoring Implementation

There are four key phases in transaction monitoring (TM) implementations and how a bank should design and execute these phases. Successful implementation of rule selection, data prep, segmentation, tuning and operational optimization will determine the success of the overall TM implementation in your organization.

Matrix-IFS is Attending ACAMS Florida (April 15-17)

On April 15–17 Matrix-IFS will be taking part in one of the largest Financial Crime Conferences in the US – ACAMS Florida, which will take place at the Diplomat Resort & Spa in Hollywood, Florida. This 3-day conference brings together vendors, industry thought leaders and various financial institutions from across the world.

The Problem with AML Today & How to Fix It: Part I – The AML Problem

The latest discoveries around the massive scale of money laundering at Danske Bank and ING are just two of the most recent examples of an underlying problem with the Anti-Money Laundering (AML) discipline. Despite increasing efforts and investments focusing on the AML problem, money laundering techniques continue to evolve and evade the controls implemented by Financial Institutions (FIs). More and more industry voices decry the efficiency and effectiveness of the current AML approach – which entails running all transactions through a series of automated checks to spot anomalies based on a large set of pre-defined typologies provided by experts.

Applying Robotic Process Automation in AML & FIU Operations

Learn how RPA can increase efficiency, lower risk, and trim your overhead

Matrix-IFS Hosts 4 Anti-Financial Crime Webinars

Matrix-IFS introduces a series of timely and informative webinars on new issues, trends and solutions in Anti-Financial Crime. Webinars are designed to update and inform risk, compliance, control room and fraud professionals working in financial institutions and capital markets.

Supercharge your FIU’s Operations with RPA at ACFE Las Vegas

During The 29th Annual ACFE Global Fraud Conference Anshul Arora , Head of FL Delivery Center will present Matrix-IFS’s RPA solution for improved operations and increased efficiency. During his session, Anshul will explore a new vision of a modern FIU department, which incorporates Artificial Intelligence, Machine Learning and advanced analytics to address and reduce alerts as well as how robotics and automation can play part in reducing risk and simplifying the work of the Investigators.

Top 6 Deal / List Systems Challenges and How to Solve Them

You know the challenges associated with your Deal Management (DMS) and List Management (LMS) systems & processes. You may even be aware of the full burden and cost they pose to your department and your organization. Now benefit from the fresh approach firms are taking with their Deal and List Management systems to gain efficiency and save time and resources.

How to Overcome AML Operations Growing Pains Using Cutting-edge Technology? | Find Out at ACAMS Europe

During ACAMS Annual Europe Conference taking place 30 May – 1 June in Amsterdam, Matrix-IFS will participate in a panel session on the subject of AML Operations and how to fight growing pains using cutting-edge technology where we will share options to enhance performance by replacing limiting rule-based solutions with far more efficient intelligent solutions that operate within existing infrastructure.The panel will discuss combining Graph Analytics, AI/Machine Learning, and Scenario Authoring on big data to improve the quality of detection, prevention and reporting of financial crimes.

Future-Proofing Financial Crime Compliance: A Technology Blueprint for Smarter Risk Management

The evolution of threats to the financial system is outpacing advancements in Financial Crime Compliance (FCC) regulations and technology used by financial institutions (FI). In this situation, FI can save considerable funds, by creating or evolving their business architecture with a view of adapting to emerging threats and the advanced tech that will be required to tackle them.

Matrix-IFS Named “Top 10 Risk & Compliance Solution Providers 2018”

Since 2006, Matrix International Financial Services (Matrix-IFS) has been helping financial institutions strengthen business compliance and address financial crimes and fraud issues, with a goal to satisfy both regulators and clients with effective, efficient and cost-effective solutions.

Quick answers. Real solutions.

Let’s Connect and Explore How We Can Help

Fill out the form and our team will get back to you shortly.

Quick answers. Real solutions.

Let’s Connect and Explore How We Can Help

Fill out the form and our team will get back to you shortly.

Thank you!

Thank you!

Please submit your details